ROULA KHALAF’S FINANCIAL TIMES HIDES THE VEILS

by John Helmer, Moscow

@bears_withRoula Khalaf (lead image, right) is the only editor of a major London newspaper about whom next to nothing important is obvious, not even her name. She was appointed last year by Tsuneo Kita (front row), chairman of Nikkei, the Japanese media group and owner of the paper, to succeed Lionel Barber as editor.

The disguise is for policy reasons, according to two people close to the matter. Khalaf Razzouk began her career in the Financial Times (FT) in 1995. She has advanced over the past 25 years, FT sources claim, by taking orders from her superiors and never reporting outside the guidelines of the FT’s management. Conformity to the interests of the beneficial owner has been the rule of her journalism; anonymity her method for concealing from readers what the beneficial owner’s interests are. This combination of conformity and anonymity has provided Khalaf Razzouk with one target to be attacked on every front and at every opportunity. That’s the combination of Syria and Russia.On January 20 of this year, Kita assigned Khalaf a seat on the board of Financial Times Limited, the entity through which the Japanese run their marginally profitable London property. The UK company registration reveals that Khalaf is a maiden name, and that her legal name is Roula Khalaf Razzouk.

This is Khalaf Razzouk’s policy; and she conceals it for personal reasons also. They spring from her husband’s business interests and his and her background in the well-known el-Solh family of Beirut. From the el-Solhs have come four Lebanese prime ministers on the Sunni moslem side of the Beirut line; a financial and political alliance against the Saudi succession of Crown Prince Mohammed bin Salman; together with considerable wealth which the family has accumulated over almost a century. The husband’s name is Assaad Wajdi Razzouk. Khalaf manages to keep his personal details as secret as her husband and their families in Beirut keep her secret.

What to make of the truthfulness of the newspaper Khalaf Razzouk is now directing when it demands transparency and accountability from its targets, but not from its director?

There are just five directors of Financial Times Ltd. But only one of them has shareholding power – that’s Motohiro Matsumoto (left). He is the general manager of Nikkei’s global business division. He takes his running orders from Kita, Nikkei’s chairman and a long-time media executive. Matsumoto replaced Hirotomo Nomura on March 25, 2020. The limited company is a wholly owned unit of the Financial Times Group. When Nikkei bought it from Pearson Plc in 2015, Nikkei became the sole shareholder of the group, and of the limited entity.

The company is marginally profitable. Nikkei doesn’t care, explains a London investment banker who has loaned them money.

“This is prestige – a Japanese advertisement for themselves.”

For displaying their crown jewel, the Japanese chose a woman they knew to be kin to the crown jewels of Lebanon, Saudi Arabia, Morocco too; and with accreditation from the only other power that counts for Nikkei – the United States. The US market, according to the latest financial report filed for 2018, is the FT’s growth market, as it has been losing reader revenue elsewhere. If not for the US audience, the FT would be loss-making.

When Nikkei announced the new editor, Kita said he expected her to “pursue the FT’s new agenda covering business, finance, economics and world affairs…We look forward to working closely with her to deepen our global media alliance.” Exactly what the Japanese mean by a “new FT agenda” they haven’t said.

Kita did tell an American interviewer last November what he means by “working closely”. By rotating Nikkei managers into the FT and FT editors into Nikkei, the Japanese are keeping close tabs (right) on the “new agenda”; Kita referred to editors, not reporters or journalists.

“In the newsroom, we’ve got, for example, the Nikkei Asian Review, which has a couple of FT editors all the time. I mean, people rotate, but at the moment, I think we have two or three FT editors working for the Nikkei Asian Review in Tokyo.

“On the commercial side, sometimes it’s a shorter trip, sometimes it’s three months. In some cases it’s a year or two years that we have people from FT, we have people going from Nikkei to FT. There’s a variety of formats. It is increasing. And the collaboration becomes more like business as usual.”

Speaking through an interpreter, Kita also told the interviewer: “There are many, many ways you can evaluate your company. You’ve got tangible assets, you’ve got intangible assets. The intangible part of the Financial Times is invaluable for Nikkei. Nikkei has changed since we acquired the FT. Without the FT, it wouldn’t have been possible for us to transform ourselves as we have. Even before we acquired the FT, Nikkei had been pursuing the strategy of globalization. The addition of the FT is actually promoting that strategy in a big way.”

By globalization Kita meant Americanization. “If you look at the Japanese market, it is quite clear that the market is actually shrinking because of the population decline. So, in order to grow, we had to go to overseas. And since we are based in Asia, Asia is our No. 1 priority. In order to do that, we have set up editorial headquarters in Bangkok and commercial headquarters in Singapore. Of course, the first step is always Asia and then the next step is probably the U.S. Japan, especially, has very strong ties with United States in terms of the economy, business, financial markets. So maybe we started with Asia, but we’ll go to the United States.”

Khalaf and Razzouk are among the few members of their family to have been educated (both of them) at two New York universities, Syracuse University and Columbia, and not to have graduated in the universities of Beirut or Paris. Razzouk was born in Beirut in November 1964; his wife in May the following year, according to UK Companies House registration records. They were at Syracuse at the same time. At Columbia Razzouk was at the business school, class of 1988; the next year his wife graduated from the school of international affairs.

Khalaf Razzouk has reported that her first job was at Forbes; New York residential records show a string of her addresses in Manhattan between 1990 and 1992. She started at the FT in 1995.

The notice of director’s appointment (top) reveals for the first time that Khalaf Razzouk was born in May 1965. In identifying her nationality as British, the UK Companies House record omits to reveal that she also holds Lebanese citizenship, a point she put first in her Wikipedia entry.

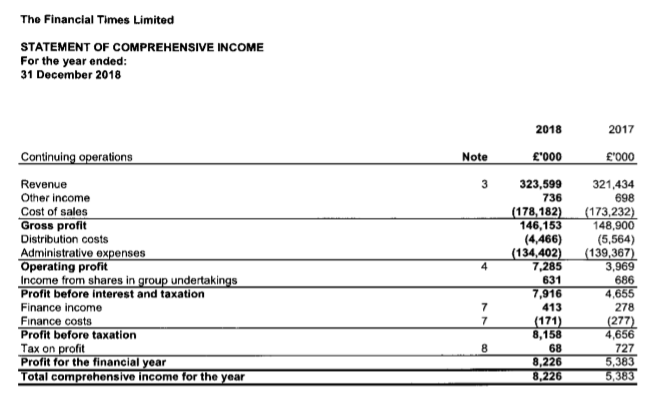

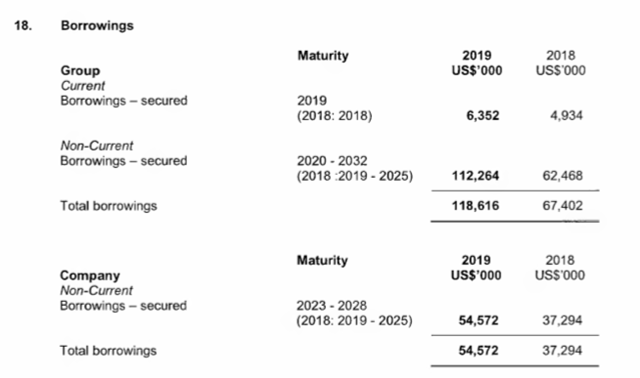

The Companies House records can be found here. The financial report (below) also reveals that when Nikkei reported £8.2 million in net income from the FT for 2018, that made almost 18% of Nikkei’s global profit of £46.4 million. Nikkei’s consolidated sales revenue for the year was £2.5 billion; of that, the FT’s revenue figure of £323.6 million comprised 13%.

Razzouk and Khalaf Razzouk had their first son Marek in 1996, when they were living in London. They subsequently had a daughter, Sari. At the time Razzouk worked for the Japanese as an investment banker at Nomura International Plc.

The full family can be found here in the announcement of the death last September in Beirut of the family matriarch, Sana el-Solh. Listed in the memorial notice by seniority is her oldest son, Assaad; her daughter, Assaad’s sister, is Nayla Wajdi Razzouk; she works for Bloomberg as its News Managing Editor for the Middle East and North Africa. She is Roula Khalaf Razzouk’s sister-in-law, she writes under the Razzouk name.

Sana el-Solh’s second son, Assaad’s brother, is Nadim Wajdi Razzouk. He records himself as a resident of New York, a trustee of the Razzouk Trust, and chief executive of an investment fund called Piolet Capital, also registered in New York. The Razzouk Trust appears to be the controlling stakeholder of the Piolet fund. Nadim holds Brazilian nationality. The two brothers were directors of Sindicatum Holdings Ltd., a UK registered entity which Assaad set up after leaving Nomura in 2002, along with a Japanese banker named Kozo Yamazoe. Yamazoe’s son currently works for Razzouk in Manila.

Sindicatum Holdings turned into Sindicatum Sustainable Resources in 2005, and into International Sindicatum Climate Change Partnership and Sindicatum Carbon Capital Limited (both registered in Cayman Islands), and Sindicatum Renewable Energy Company Pte. Ltd (Singapore). Details of a $279 million securities offering and sale by the group can be found in this October 2009 report to the US Securities and Exchange Commission.

The group remains based in the UK with multiple company names and registrations. Their personnel are interchangeable. The FT has quoted Assaad Razzouk in promotional references to Sindicatum twice – once in 2012; and again in 2015.

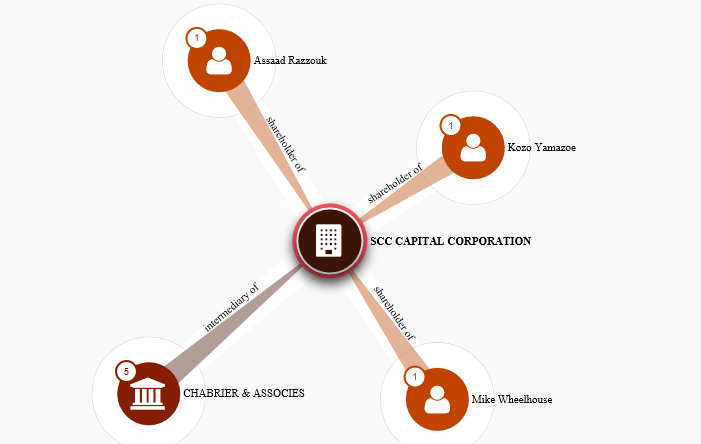

The Panama Papers archive reveals one entry for Razzouk (Yamazoe also); this is a shareholding in SCC Capital Corporation, a British Virgin Islands entity established for Razzouk by the Panamanian law firm Mossack Fonseca. The connection lasted from 2005 to 2014, when the company was deactivated, then dissolved. SCC may be short for Sindicatum Carbon Capital or Sindicatum Climate Change.

Roula Khalaf Razzouk was recorded as living at 5 De Vere Gardens in Kensington in 2005; Assaad Razzouk lists his current home address in UK and US company records as Flat 5, 37 De Vere Gardens.

Left, 5 De Vere Gardens, Kensington; right, 37 De Vere Gardens. In the late 19th century Robert Browning and Henry James lived on the street. In 2015 De Vere Gardens was the fifth most costly street in England, with an average house price of £7.4 million. Recently, the residents have been active in the High Court to protect their residences from pigeon droppings.

In Lebanese politics, Solh family members have been Politically Exposed Persons (PEPs), as the term is now in current use in the UK for identifying and regulating money-laundering by foreign state officials, their families and business associates. The interlocking trusts, funds, banks and collateral pledges of the Solh family and their associates are Levantine in their complexity. Whether the time limit for PEP office holding has expired for them in Lebanon, according to the UK regulations, isn’t known. No wrongdoing has been implied, alleged, or identified against them in the UK.

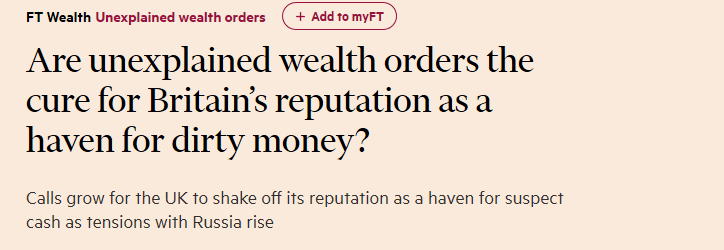

In the investigations of unexplained wealth launched by the National Crime Authority (NCA) under the new UK Criminal Finances Act, the FT has reported allegations of many Russian targets; no Lebanese.

“The list of nationalities suspected of money laundering in the UK is long, but since the Skripal case the focus has been almost exclusively on Russians, notably Putin’s allies and acquaintances” – FT, April 30, 2018.

"Are we looking at potential Russian targets? Of course we are,” Mr [Donald] Toon [NCA economic security unit] told the Financial Times.

“We are looking at high-value Russian assets inside the UK . . . and whether or not we can be in a position to go to the courts and raise sufficient concern to obtain an unexplained wealth order on those assets” – September 13, 2018.

Razzouk’s Sindicatum website reports many awards for its good works; the financial reports show it is loss-making and heavily indebted.

Industry sources believe Razzouk’s group started out as a carbon credit originator in London. When that market collapsed in the mid-2000s, the group refocused on Third World electricity generation projects such solar and wind power, waste conversion to energy, and landfill methane capture. The technical requirements for success in projects like these, one source says, are “technically challenging and there is a high failure rate. [Sindicatum] has made a number of writedowns on projects and incurred losses on project sales.”

Sindicatum spends money; the money supply comes from elsewhere. Razzouk and his associates set up Sindicatum as the operating entity of a private equity fund; it is unclear how much of the borrowings comes from the fund, or from elsewhere. The operating entity is owned 30% by the original entity founded by Razzouk and 70% by the fund, but the financial reports don’t reveal if the 30% was earned through investment of cash, or by vending in rights to the underlying projects. Razzouk’s financial report claims substantial funds have been paid into Sindicatum by “top-tier US university endowment funds, foundations, fund-of-funds groups and other institutional asset managers”, plus a 20% contribution from Razzouk’s original entity. A report on the Cayman-registered International Sindicatum Climate Change Partnership Feeder Fund LP says there are 18 investors.

Razzouk’s business is deceptively complicated; his wife’s deceptively simple. Above, Razzouk presents his climate change business in Edinburgh in April 2015; with audience comments. Below: Khalaf Razzouk presents the family assets in “My Beirut,” an FT podcast of December 2017 – below left: “this plot of land was once my grandparents’ house” – Min 00:47; below right: her apartment on the Corniche – “a nice reminder for my children of their roots.” – Min. 11:41.

Like her FT colleague Chrystia Freeland, who was engaged in 2014 by George Soros to write his authorized biography, Khalaf Razzouk promoted Soros to be the FT’s “Person of the Year” in 2018. “He is the standard bearer of liberal democracy and open society,” Khalaf Razzouk reported. “These are the ideas which triumphed in the cold war. Today, they are under siege from all sides, from Vladimir Putin’s Russia to Donald Trump’s America.”

This is how Khalaf Razzouk reported the Putin siege on November 28, 2018. “On Sunday [November 24] Russia captured three Ukrainian ships in the Black Sea, in a new escalation of tensions; the Russian military has intervened in Syria and saved the presidency of Bashar al-Assad; an elaborate scheme to meddle in the US elections has been gradually uncovered; and Moscow has been accused of poisoning a former Russian agent in the UK. The list continues.” There are five serious errors of fact, one in every clause – and that isn’t counting the errors of fact in the headline:

November 28, 2018 -- source: https://www.ft.com/

“Our corporate creed,” Khalaf Razzouk’s boss in Tokyo said after appointing her, is “that it’s through fair and impartial reporting that we contribute to the peaceful and democratic growth of the economy. That’s our corporate decree. So this is our mission.”

Khalaf Razzouk demonstrates the Nikkei mission is information war against Russia, Syria, Saudi Arabia, China too. That’s a secret mission as obvious as her name.

No comments:

Post a Comment